- USHA KIRANA, Jayanagar, Bangalore, India

- rfsnationalb@gmail.com

- 91-080-26575389

Here

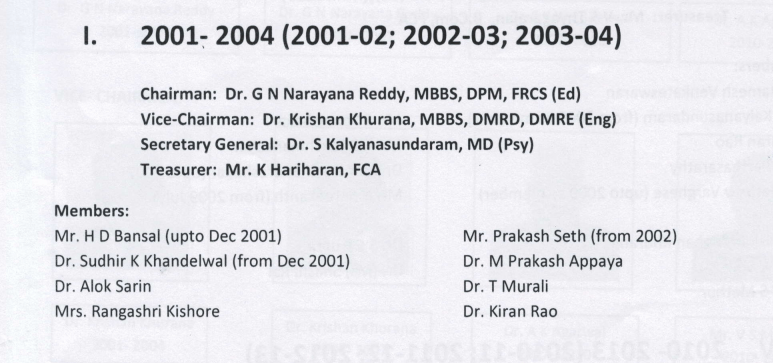

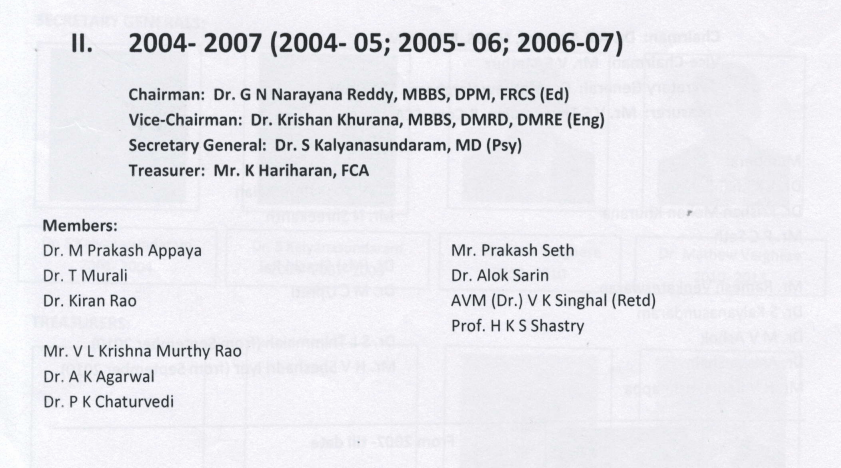

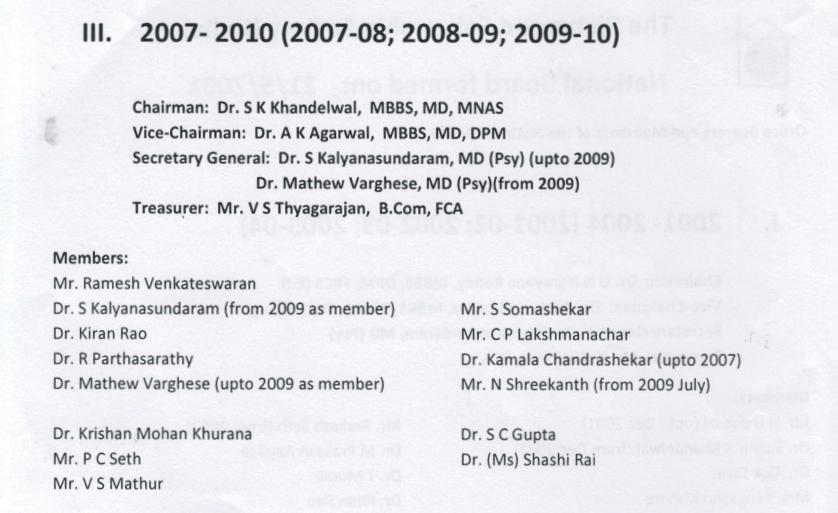

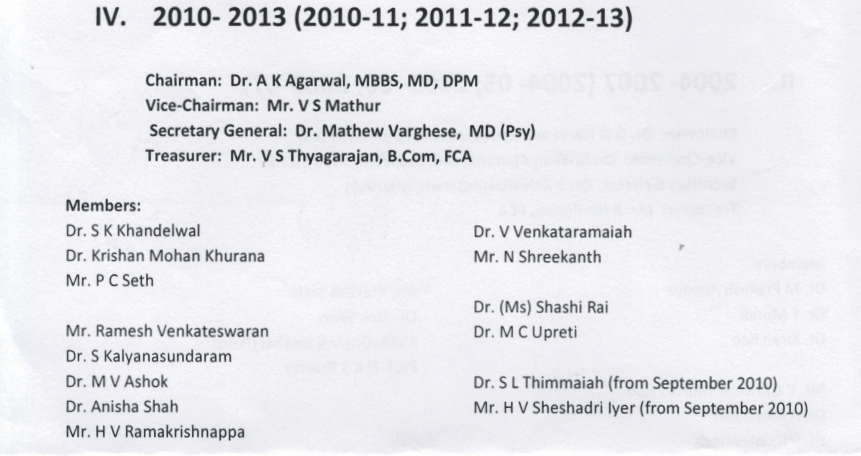

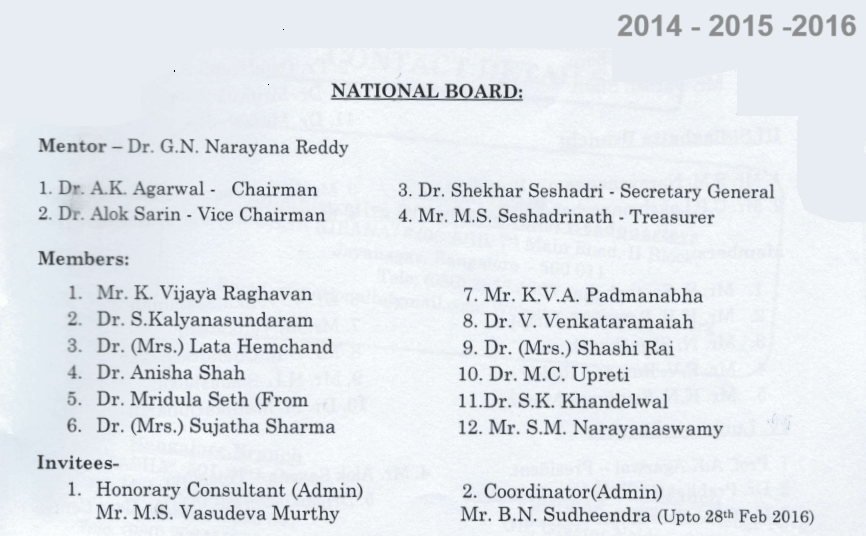

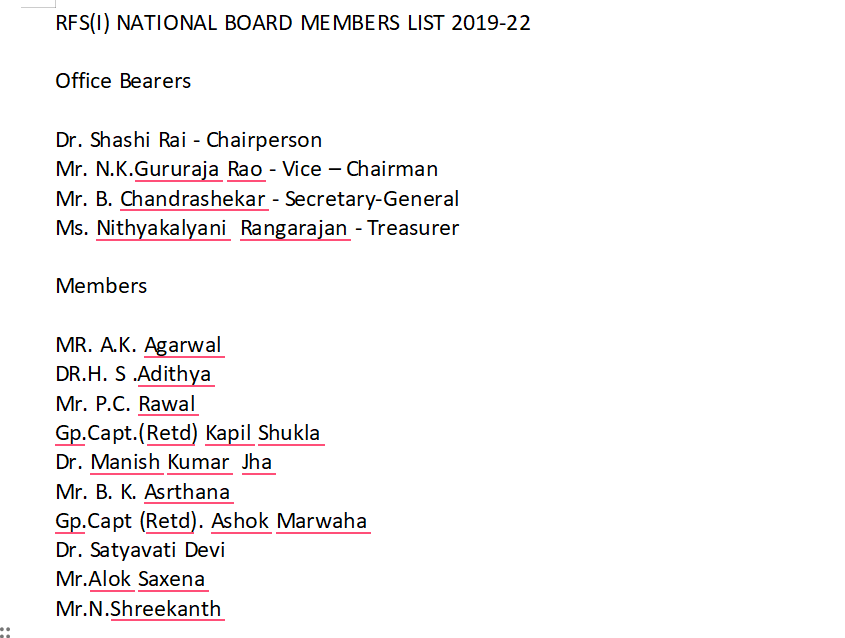

National Board : Office Bearers and Members 2001 to 2022

Here

This is the first of a two part series on why health insurance companies refuse to reimburse treatment cost of mental illness, despite laws and insurance regulator guidelines saying they must treat mental illness on par with any other physical illness.

“I bought a health insurance policy from a well-known insurance agency in 2014,” says V Naresh, 73, (name changed on request). “In January 2020, my 39-year-old son, who was diagnosed with a psychiatric illness, was admitted to rehab for 25 days. In March 2020, I put in a claim of around Rs. 2.75 lakh for the treatment, but it was rejected”. The reason given by the insurer was ‘Permanent Exclusion.’

Permanent Exclusion applies to categories of treatments not covered in health insurance policies. There are approximately 17 listed categories of treatments in the health policy which are ‘excluded’ like epilepsy, congenital heart disease, cerebral stroke, chronic liver and kidney diseases, hepatitis B, Alzheimer’s, Parkinson’s, HIV and AIDS, loss of hearing, and physical disabilities. However, ailments, like, Alzheimer’s, Parkinson’s, AIDS/HIV infection, and morbid obesity, if contracted after buying a health cover, are not excluded. Before MHCA, 2017 and IRDA circular, any mental illness was included in the list of ‘Permanent Exclusion’.

Naresh’s is not an isolated story. There are many others whose claims for a person living with mental illness have been ignored by insurance companies. The other reason generally given is ‘substandard existence’.

Also, rarely do the insurance companies give the reason for rejection in writing. “Insurance companies are usually reluctant to give anything in writing,” said Naresh. “Be it Star Health Insurance, Care Health, or any other company, the reason is mostly communicated verbally. Never in writing”.

At times, insurers just stop responding to such customers. “Phone calls, emails, or physical meetings with these customers would be ignored,” says Gaurav Kumar Bansal, a Supreme Court lawyer.

Gaurav had filed a PIL in 2020 (still under consideration), questioning why insurance companies have not included the cost of mental illness in medical insurance despite the Mental Healthcare Act, 2017 (MHCA) that brought mental illness on par with physical illness.

Mental Healthcare Act, 2017, Section 21(4) states:

Mental illness should be treated in the same way as physical illness.

There should not be any kind of discrimination in terms of age, gender, sexual orientation, or any kind of disability.

Persons suffering from any kind of mental illness or disorder should be provided with the use of ambulances, equal living conditions in health establishments and are liable for every kind of health service.

The insurers should have a provision for the treatment of mental illness by providing medical insurance in terms of mental health.

Law vs reality

“Under article 21 it is a person’s fundamental right to get insured and if they are being deprived of the insurance because of a mental illness, it’s a shame,” adds Gaurav. “On international platforms, India has committed that we will provide health insurance for mental illness. Insurance companies that do not cover mental illnesses are violating section 21(4) of the Mental Healthcare Act 2017 and the Insurance Regulatory Development Authority (IRDA) of India’s circular number 128 dated August 16, 2018.”

According to the Mental Healthcare Act 2017, section 21(4), “every insurer shall make provision for mental insurance for the treatment of mental illness on the same basis as is available for the treatment of physical illness.”

Health insurance companies can, in fact, be prosecuted under section 109 of the Mental Healthcare Act 2017 for not following section 21(4).

The IRDA had issued circulars in 2018 and 2020 to include mental illness under insurance coverage. But insurance companies have failed to comply. “The circulars brought people living with mental illness on par with any other illness, such as diabetes or heart ailments, etc,” says Vijay Nallawala, Founder of Bipolar India and Co-Founder of the Mental Health Support Foundation.

“Subsequently, the IRDA also issued guidelines. But the insurers demanded time to frame policies on various illnesses,” adds Nallawala. “They said that they do not have adequate data about how to underwrite this policy, primarily meaning the claims vis-à-vis premiums. They said they needed time to work out a sustainable business model.”

Insurance cos ignore IRDA guidelines

But even four years after the IRDA circular, insurance companies do not provide health insurance for people with mental illness.

Officials and sales agents at insurance companies are mostly unware of the MHCA, 2017 and IRDA guidelines. On September 30th, 2019, IRDA issued guidelines barring the exclusion of ‘mental illnesses, stress or psychological disorders, behavioural and neuro-developmental disorders’ from health insurance policies. Despite this, only a handful of insurers have complied with the guidelines. The agents selling the policies are ignorant about the changes.

To cross-check the ground reality, I talked to a sales agent of a primary health insurance company, Star Health, as a customer. When I asked him if insurance could be taken for a young person with a mental health issue, he straight away refused.

When I persisted in knowing the reason for refusal, he gave the call to his manager. The response from the other end was: “If it is related to the brain, then it would be included in ‘Permanent Exclusion.’ Only the underwriter can approve the policy. And if the underwriter finds that there is a high risk, then it will be rejected, but if the risk is low, then there would be a three-year waiting period.”

When I apprised them about MHCA, 2017 and IRDA guidelines, I was told to fill up the proposal form and wait for the underwriter’s comments. “Till the underwriter gives his comments, we’ll not collect the cheque. This much relief I can provide from my end,” the manager said.

“Medical care is every citizen’s fundamental right under Article 21, which read with Article 15 disallows any kind of discrimination,” reiterates advocate Gaurav Bansal. “The insurance companies are bound to obey the law of the land.”

Gaurav has flagged many such issues in the courts. “My petition is in the Supreme Court and the Supreme Court has issued notices to the agencies as well as to the Ministry of Social Justice and the Ministry of Health and Family Welfare,” explains Gaurav.

Insurance company’s claims

“To some extent, the scenario has changed, at least on paper. Insurance agencies say that they are providing health insurance to people with mental illness for more than 300 products. But when we talk about practicality, I see a lot of gaps, and many people have shared their experiences of discrimination with me and in several mental health groups. I try to take up their cases, pro bono,” says Gaurav.

The IRDA has given many extensions to insurance companies to devise new products that are compliant with their guidelines. “The last extension was given on April 1st, 2020,” points out Vijay Nallawala. “But proposals for policies still get rejected when there is a disclosure of mental health issues. Why so?”

According to Gaurav Bansal, nearly 50% of hospitalisation claims are rejected. “To avoid rejection, caregivers often hide mental illness,” he says.

People buy insurance policies expecting they will get financial support during a medical emergency. But when the claims are rejected, the economic structure of the families collapses. “The insurance companies are solely responsible for this,” adds Nallawala.

V Naresh, caregiver to his son, has experienced several difficulties trying to move from one insurance provider to another as well as braving his own 73-year-old body’s health issues. “We have spent a lot of money on medical expenses, and my health has also started deteriorating,” says Naresh. “My wife is 70 now and I also have to take care of her. Because of financial difficulties, we keep moving from one place to another.”

He has given his spacious house on rent and is living in a smaller rented accommodation to support his son’s treatment. “The insurance companies do not realise the lifelong impact on caregivers and families by rejecting our claims,” laments Naresh. “They and the people representing them should be supporting us more”.

Mental illness coverage among various health insurance providers

The research and findings of the Indian Mental Health Observatory (IMHO) reveal:

- ACKO- Group Health Insurance Policy: Approved by IRDA on 28.9.20 – states under the policy description that –“Neurosis and psychiatric illness is excluded.”

- ACKO-Health Insurance Policy: Approved by IRDA on 21.5.2020 – states under policy description- “OPD cover is included, all psychiatric related clauses are excluded.”

Aditya Birla – Group Arogya Sanjeevani Policy: Approved by IRDA on 09.09.2020 – Domiciliary hospitalisation expenses for psychiatric or psychosomatic disorders are not covered.- Bajaj Allianz- Extra Care: Approved on 12.08.2020 – for Mental illness, 25% of the sum insured or 200,000 whichever is lower.

- Care Health-Assure: Approved on 20.09.2020 – Neurosis and psychiatric illness not covered.

Financial security for self and family members is of paramount importance in one’s life and people work hard to create wealth and provide for safeguarding the welfare of family.

The need to provide such financial security becomes a little more complex for parents with special children. Such children require greater financial support to meet not only their regular living expenses, but also, the medical expenses, attendant expenses, special education needs and other expenses to provide comfort to such child.

Though parents of such children have adequate financial resources to provide financial support, but, one of the concerns for such parents is to ensure the financial security to special child especially after their life. Bequeathing the estate through “WILL” to special child is not a suitable option as child is not capable of managing the estate due to disability.

The other option for such parents is to leave the estate with a family member (brothers/sisters) and with a direction to use such estate for the wellbeing of special child. But the flipside of such arrangement is that there could be change of mind of such person or legal impediments in management of estate or a void due to death or disability of relative.

Setting up a private trust with an objective of wellbeing of child and leaving the legacy to the trust is perhaps is suitable option in ensuring the financial security of special child.

A trust is a relationship where property is held by one party for the benefit of another party. A trust is created by the owner, also called a “settlor”, “trustor” or “grantor” who transfers property to a trustee. The trustee holds that property for the trust’s beneficiaries.

The person who transfers the property to trustee/s is called the “author” or “settlor” of the trust; the person who accepts the trust is called the “trustee”, the person for whose benefit the property is accepted is called “beneficiary”; the subject matter of trust is called “trust property”; the beneficial interest of the of the beneficiary is his right against the trustee as owner of the trust property; and the instrument, if any, by which the trust is declared is called “instrument of trust” or “trust deed”.

Under Indian Trust Act, a settlor can create a trust with his or her own personal property and can officially appoint one or more trustees and lay down the terms and conditions benefiting the identified beneficiary or beneficiaries including one’s spouse, own child, relative or any other individual or group of individuals.

A Private trust could be created for the benefit of one specific beneficiary which is also known as 100% specific beneficiary trust. In such case, the entire benefit of the trust would go to the specific beneficiary named in the trust.

In the event of financial difficulties for the parents to provide for well being of special child, seeking financial support from family/extended family members or other members of society may give confidence to such members to contribute to the Trust as their contributions are applied judiciously for the welfare of the special child.

All incomes (other than the exceptions) of a minor child, whether direct or through a trust would be clubbed or added with the income of the minor child’s father or mother who has a higher taxable income. (U/s 64 (1A) of Income Tax Act).

As per Sec 64 (1A) of Income Tax Act, any income of a minor child who is suffering from disability of the nature specified in section 80U like physical disability, blindness etc. will not be clubbed with the income of the parents.

The specified disease u/s 80 U :-

- Blindness

- Low vision

- Leprosy-cured

- Hearing impairment

- Loco motor disability

- Mental retardation

- Mental illness

- Autism

- Cerebral palsy

A specific beneficiary private trust with adequate provisions provides substantial safeguards to protect and provide the funds for the wellbeing of special child. And, as per the current Income Tax provisions (FY 2019-20) the income arising to special child either directly or indirectly is exempted from clubbing with the income of parent who has a higher taxable income.

A Suresh Chartered Trust and Estate Planner TM

Brief about the Article:

The need to provide such financial security becomes a little more complex for parents with special children. Such children require greater financial support to meet not only their regular living expenses, but also, the medical expenses, attendant expenses, special education needs and other expenses to provide comfort to such child.